Validation Agents

There are numerous reasons why organizations should consider becoming a Validation Agent within the Global LEI System:

- Offer a faster and more efficient customer experience when onboarding clients and performing refresh updates.

- Enhance internal data management processes by offering greater consistency and reducing costs.

- Accelerate digital transformation.

- Benefit from opportunities to add client value and market differentiation.

- Stay ahead of the regulatory mandates and already include the LEI as part of the good practices recommended globally.

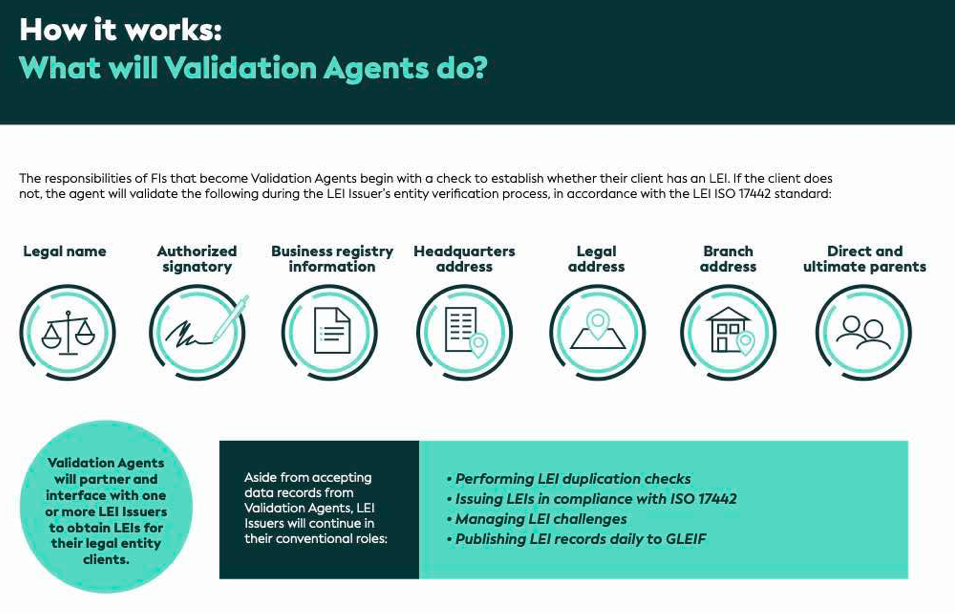

The Validation Agent role allows financial institutions and other organizations involved in identity verification and validation to obtain and maintain LEIs for their clients in cooperation with accredited LEI Issuing Organizations. Validation Agents achieve this by leveraging their business as usual client identification procedures in Know Your Customer (KYC), client onboarding or standard client refresh update processes.

The role was designed to remove the duplication of processes across an organization's client onboarding and LEI issuance, resulting in a simpler, faster and more convenient experience for both the Validation Agent and their clients, enabled by a more efficient LEI issuance process.

Benefits for…

Benefits for Sell-side institutions

- Improved customer satisfaction through an add-on service

- Reduced onboarding time for entity clients

- More efficient renewal during refresh cycle

- Avoid potential contractual fees for delayed onboarding

- Continuous regulatory compliance

- Enhanced internal data management processes, greater consistency with standardized entity reference data

- Cost reduction due to generated efficiencies

- Accelerated digital transformation

Benefits for Buy-side institutions

- Unique identification of proprietary funds at the time of origination

- Unique identification of all parties to a fund structure (trustee, advisor, sub-advisor, custodian, etc.)

- Timely and unique identification of issuers of financial instruments

- Efficient connectivity with fund custodian and admins who utilize the LEI

- Smooth and efficient engagement with sell-side banks

- Avoid potential contractual fees for delayed onboarding

- Continuous regulatory compliance

- Enhanced internal data management processes, greater consistency with standardized entity reference data

- Cost reduction due to generated efficiencies

- Accelerated digital transformation

Benefits for KYC service providers and data vendors

- Attract more institutions who harness the LEI

- Easier and faster communication

- Improve customer service

- Ensure single identifier within onboarding tools for entity clients

- Become an industry leader among other service providers

- Extend existing data services for LEI Issuer

- Shorten onboarding time for clients

- Enhanced internal data management processes, greater consistency with a standardized entity reference data

- Increased efficiencies for burgeoning areas such as environmental, social, governance (ESG) data collection

Benefits for Multinational Corporations (legal entity clients)

-

Follow a data driven approach and facilitate the corporate treasurer’s workflow:

- Simplify, secure, and digitize processes across treasury departments

- More precision on the company subsidiaries results in better resource planning of resources for internal payments

- Easier and quicker onboarding process

- Better and streamlined relationship with bank

-

Future proof your organization vis-à-vis paperless trade, cross-border payments and digitization of trade documents.

-

Use your company’s LEI in digital certificates and perform transactions (regulatory filing, contract signing, etc.) digitally.

-

Create an organizational wallet based on LEI - have more visibility over who performs which task on behalf of the company.

-

Avoid any possible regulatory penalty.

Benefits for Small & Medium Enterprises (legal entity clients)

- Access to cross-border payments, credit facilities, and supply chains without identity restrictions

- Improve access to finance and corresponding banking relationships

- Gain more visibility in e-platforms

- Accelerate digital transformation

Benefits for LEI Issuing Organizations

- Move early and be a leader in your jurisdiction(s)

- Increase LEI volume under your management through economies of scale.

- Ensure better visibility with regulators.

- Reduce costs for verification and validation.

- Removal of process duplication for validation of entity data

- Increase share of LEIs under your management in different industries and expand your network.