Why the LEI?

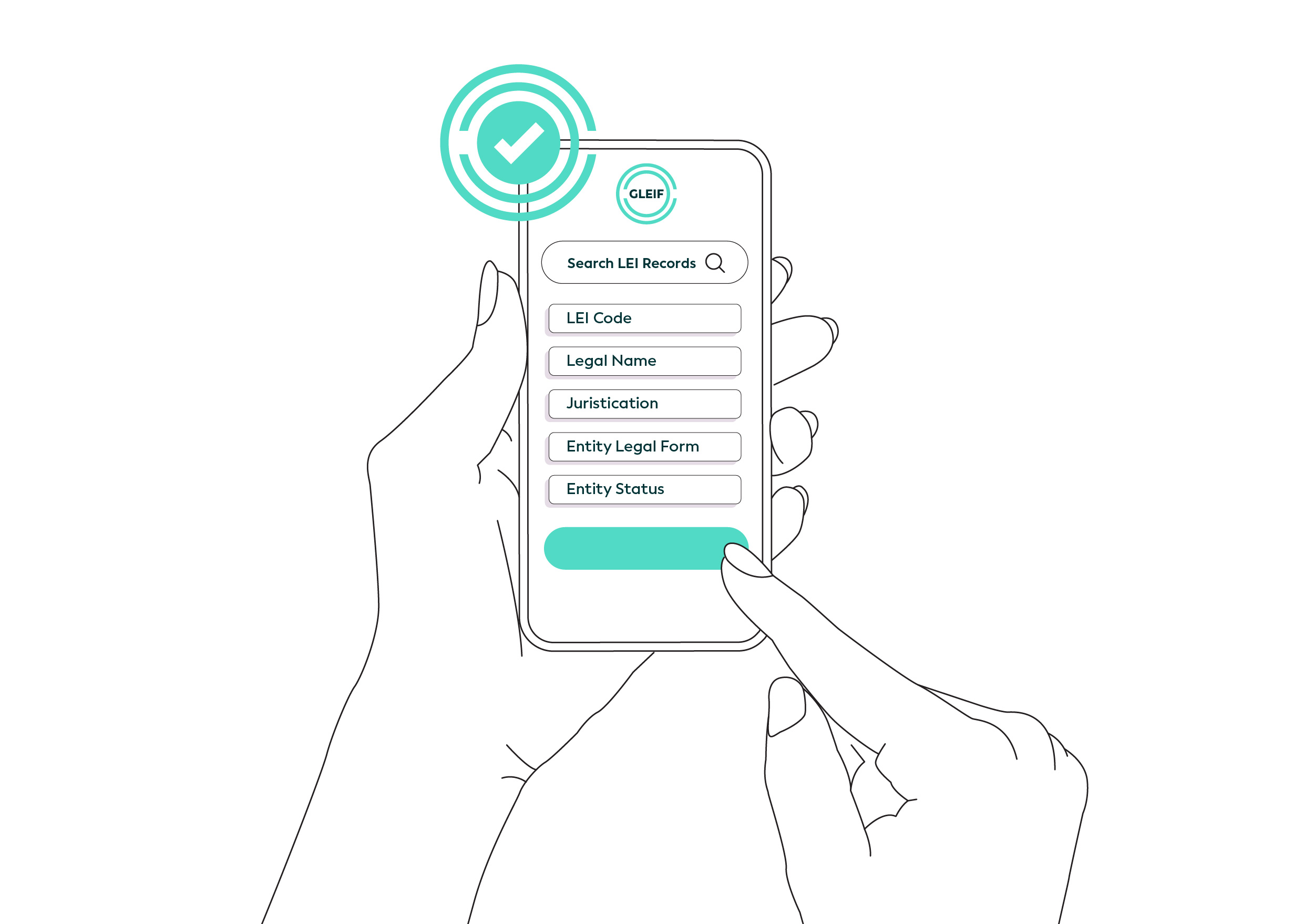

The LEI enables clear and unique identification of legal entities participating in any transaction globally. It does this by connecting to an entity’s key reference information, which GLEIF makes publicly accessible via its website. The LEI facilitates surveillance activities like Know-Your-Customer (KYC) and Anti-Money Laundering (AML) processes. It is widely mandated and used to ensure counterparty transparency across many sectors, including financial services, supply chain, trade finance and payments.

Featuring the LEI

The LEI empowers organizations to cut costs and make efficiencies across a wide range of business operations. It has already increased transparency within capital markets and banking by facilitating business-critical operations including KYC, client onboarding and AML processes. The LEI is now gaining momentum in other business areas like trade finance, international supply chain, and digital interactions.

Validation Agent

The Validation Agent role allows financial institutions and other organizations involved in identity verification and validation to obtain and maintain LEIs for their clients. Validation Agents work in cooperation with accredited LEI Issuer Organizations.

LEI in Regulations

Regulators in many jurisdictions have mandated the use of the LEI to evaluate risk, take corrective steps, minimize market abuse and improve the accuracy of financial data.

Featuring the vLEI

The vLEI has transformed the nature of identity management. It makes the verification of person-to-entity and entity-to-entity interactions instant and secure while maintaining data privacy and confidentiality.