LEI in Capital Markets

The white paper released by McKinsey & Company and the Global Legal Entity Identifier Foundation (GLEIF) titled ‘The Legal Entity Identifier: The Value of the Unique Counterparty ID’ clearly illustrates the applications of the Legal Entity Identifier (LEI) across the entire lifecycle of the client relationship in capital markets. The LEI’s primary value in this segment is derived from reducing the costs associated with: onboarding clients; and of middle-and back-office activities related to the processing of stocks, bonds and other securities trades.

However, its application in internal operations is also important. Internal operational teams increasingly deploy the LEI as the primary attribute that aggregates and reconciles client trade information which is often stored in disparate internal systems and tagged under different client ID numbers. They have found that internal communications and trade reconciliation-related tasks have been simplified and expedited through its use.

From counterparty identification to business value: The use of the LEI in capital markets

Banks are beginning to use the LEI as an effective identifier for client onboarding. This is particularly true for activities relating to know your customer (KYC) requirements and documentation management.

In KYC processes, firms work to verify their clients’ identity by conducting robust due diligence. The lack of consistency within these processes means that banks spend considerable time and resource on the effort. To further complicate the matter, different areas of the bank may use different identifiers for the same client, and vendors engaged by the bank to assist in the collection of KYC-related information may use their own identifiers as well. What should be a simple task is, in fact, a complex, time-consuming and resource intensive effort.

In addition to this, there can be adverse consequences for the client. For example, if a client needs to raise money quickly, they may put in an order to sell a bond or a stock. But, the bank may struggle to immediately locate the documents due to them being tagged with an account number instead of a legal entity ID and as a consequence, could block the client’s account from trading.

Broad adoption of LEIs could yield annual savings of over U.S.$150 million within the investment banking industry

In comparison, if all players in the process tagged client information with an LEI, it would be much more efficient and transparent. Beyond simplifying processes and ensuring better customer service, LEIs can also expand full time equivalent (FTE) capacity and enable banks to do business with clients faster. Typically, investment banks employ 1,000 to 1,500 FTEs who focus on onboarding and, according to McKinsey, the average onboarding process takes 120 days. If the LEI was adopted more broadly, onboarding time could be materially shortened so that banks can start trading with their clients much sooner and the onboarding team could be made available for other functions.

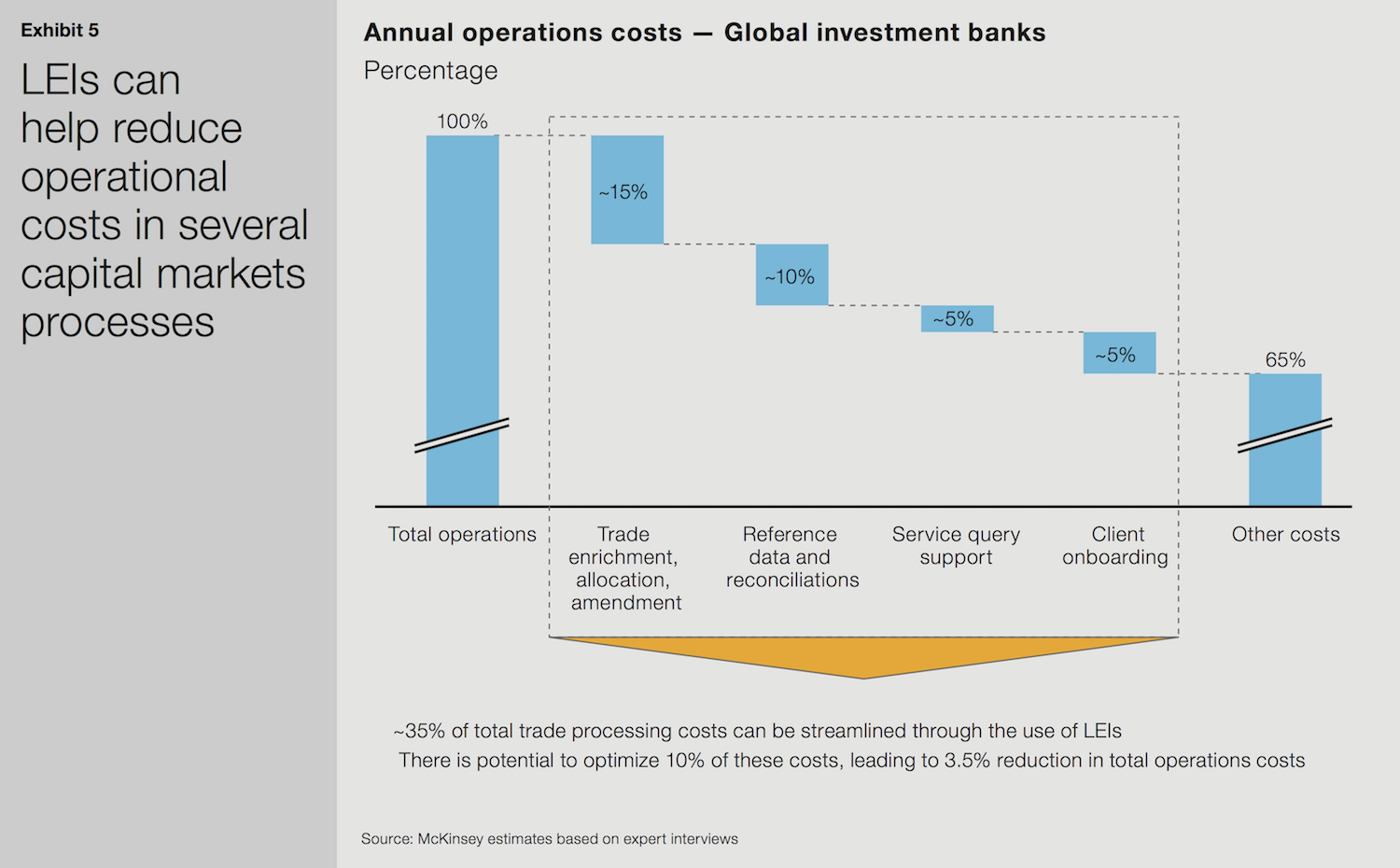

The result of the white paper was the estimation that introducing LEIs into capital market onboarding and securities trade processing could reduce annual trade processing and onboarding costs by 10 percent. This would lead to a 3.5 percent reduction in overall capital markets operations costs, amounting to over U.S.$150 million in annual savings for the global investment banking industry alone.

Banks that have yet to adopt the LEI in trade processing or onboarding could reap benefits in terms of efficiency, speed and improved client service. The benefits to all banks would be significantly enhanced if a greater number of legal entities obtained LEIs. More specifically, they could expect to gather additional revenue by shortening ‘time to market’ for trading with customers while simultaneously improving the client experience.

LEI removes complexity from onboarding client organizations

For more information on how broad LEI adoption can remove complexity from onboarding client organizations and deliver quantifiable value to financial services firms, refer to the GLEIF research report titled ‘A New Future for Legal Entity Identification'.

The report outlines the results of GLEIF research on the challenges of entity identification in financial services, including know your customer (KYC) due diligence. It also shows how replacing disjointed information with a globally accepted approach, based on broad adoption of the LEI, would remove complexity from business transactions and deliver quantifiable value to financial services firms.

To learn more about LEI use cases described within the joint McKinsey and GLEIF white paper, refer to these dedicated GLEIF website pages: ‘LEI in Trade Finance’ and ‘LEI in Commercial Credit’.