LEI in Trade Finance

The white paper released by McKinsey & Company and the Global Legal Entity Identifier Foundation (GLEIF) titled ‘The Legal Entity Identifier: The Value of the Unique Counterparty ID’, discusses three use cases that demonstrate the wider potential application of the Legal Entity Identifier (LEI). These use cases – which are not meant to be exhaustive – relate to capital markets, commercial transactions, and the extension of commercial credit. The use cases are especially relevant to large corporations, small businesses and their banking institutions, and investment banks.

Banks in trade financing could save up to U.S.$500 million per annum overall by using the LEI in the issuance of letters of credit.

From counterparty identification to business value: The use of the LEI in trade finance

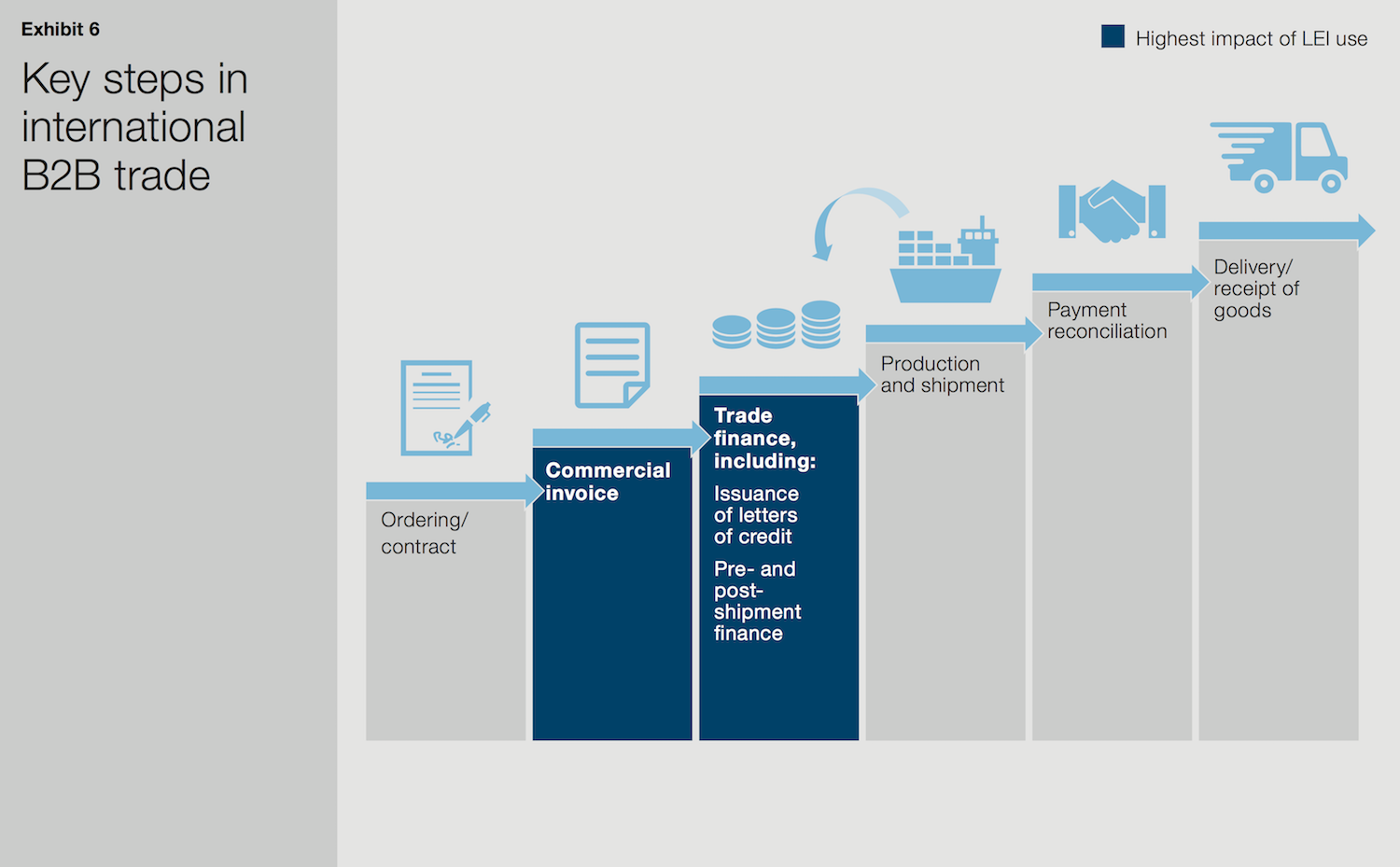

The commercial transaction lifecycle is complex. It involves ordering goods, sending invoices for the goods, obtaining trade financing, producing the goods, reconciling payments and delivering/receiving the goods. The list is endless. The white paper found that the use of an LEI could have a considerable impact on the invoicing and trade finance element of this lifecycle.

Throughout the commercial transaction lifecycle, several manual, time-consuming activities are required to complete the transaction. This is especially true of international transactions. In particular, verifying the identities of counterparties often involves a great deal of manual processing. The use of the LEI could automate identity verification and enable the digitization of several activities required in the invoicing and trade finance steps of a commercial transaction. It could even potentially reduce the time required to exchange payments.

LEIs would enable the immediate, digitized identification of entities and would allow banks to dramatically curtail the time and resources spent on background checks and investigations

Trade finance encompasses a broad range of products and services that facilitate international trade. In the application most relevant to LEIs, buyers obtain letters of credit or bills of exchange from their banks to facilitate payments to sellers, and sellers use purchase orders or invoices to obtain financing for production and purchase. The process of acquiring and using letters of credit is particularly time-consuming and typically involves multiple steps, many of which require identity checks and reconciliation. To mitigate risk and comply with anti money laundering (AML) regulation, both the buyer’s bank and the seller’s bank must conduct several counterparty checks. These controls currently rely too heavily on manual processing and paper documentation. Moreover, banks use a number of databases to perform these checks but they can only search by entity name, which creates significant risk, since multiple entities may have similar names.

These manual checks could be streamlined considerably and made far less costly through the adoption of the LEI. LEIs would enable the immediate, digitized identification of entities and would allow banks to dramatically curtail the time and resources spent on background checks and investigations. These efficiencies would be compounded by reducing the incidence of false positives based on AML and other compliance lists. Rather than searching by name, institutions could simply search the relevant databases using each entity’s unique LEI – or, in an advanced stage, using a single database.

In addition to facilitating AML efforts, the use of the LEI can mitigate fraud risk. Using an entity’s LEI, a seller’s bank could trace outstanding invoices to identify suspicious activity like multiple invoices for the same shipment.

Banks in trade financing could save up to U.S.$500 million per annum overall by using the LEI in the issuance of letters of credit

The LEI makes the following two key activities in a complicated process far simpler: verification of entities and tracking an entity’s history. On an annual basis, banks could potentially collectively save between U.S.$250 million to U.S.$500 million per annum if LEIs were used to identify international entities and to automate the tracing of their history for the issuance of letters of credit. At its maximum potential, these savings could represent four percent of the current global trade operations cost base. The lower end of this estimate assumes high adoption in Europe and North America with low adoption in Asia, while the higher end of the estimate assumes high adoption globally.

As well as these efficiencies, the use of the LEI would also facilitate better risk management by allowing banks to maintain a more holistic view of the transacting entity.

To learn more about LEI use cases described with the joint McKinsey and GLEIF white paper, refer to these dedicated GLEIF website pages: ‘LEI in Capital Markets’ and ‘LEI in Commercial Credit’.