LEI in Commercial Credit

The white paper released by McKinsey & Company and the Global Legal Entity Identifier Foundation (GLEIF) titled ‘The Legal Entity Identifier: The Value of the Unique Counterparty ID’ identifies three additional use cases for the use of the Legal Entity Identifier (LEI) relating to capital markets, commercial transactions and the extension of commercial credit. Whilst these are in no way exhaustive, they illustrate the broad application of LEIs.

When looking to extend credit to commercial borrowers, the first step for a lender is to ascertain the entity’s identity, history and ownership group-structure. This task is often much harder than expected. Many corporate groups and small businesses include numerous entities with similar names and each can then interact with the financial system in multiple ways, across multiple institutions and even in multiple countries.

From counterparty identification to business value: Using the LEI to standardize the extension of commercial credit

This complex environment means that lenders – who often have siloed IT and data systems – may find it difficult to unambiguously identify unique customers. Sharing data within and across institutions to manage risk and exposure therefore becomes complicated.

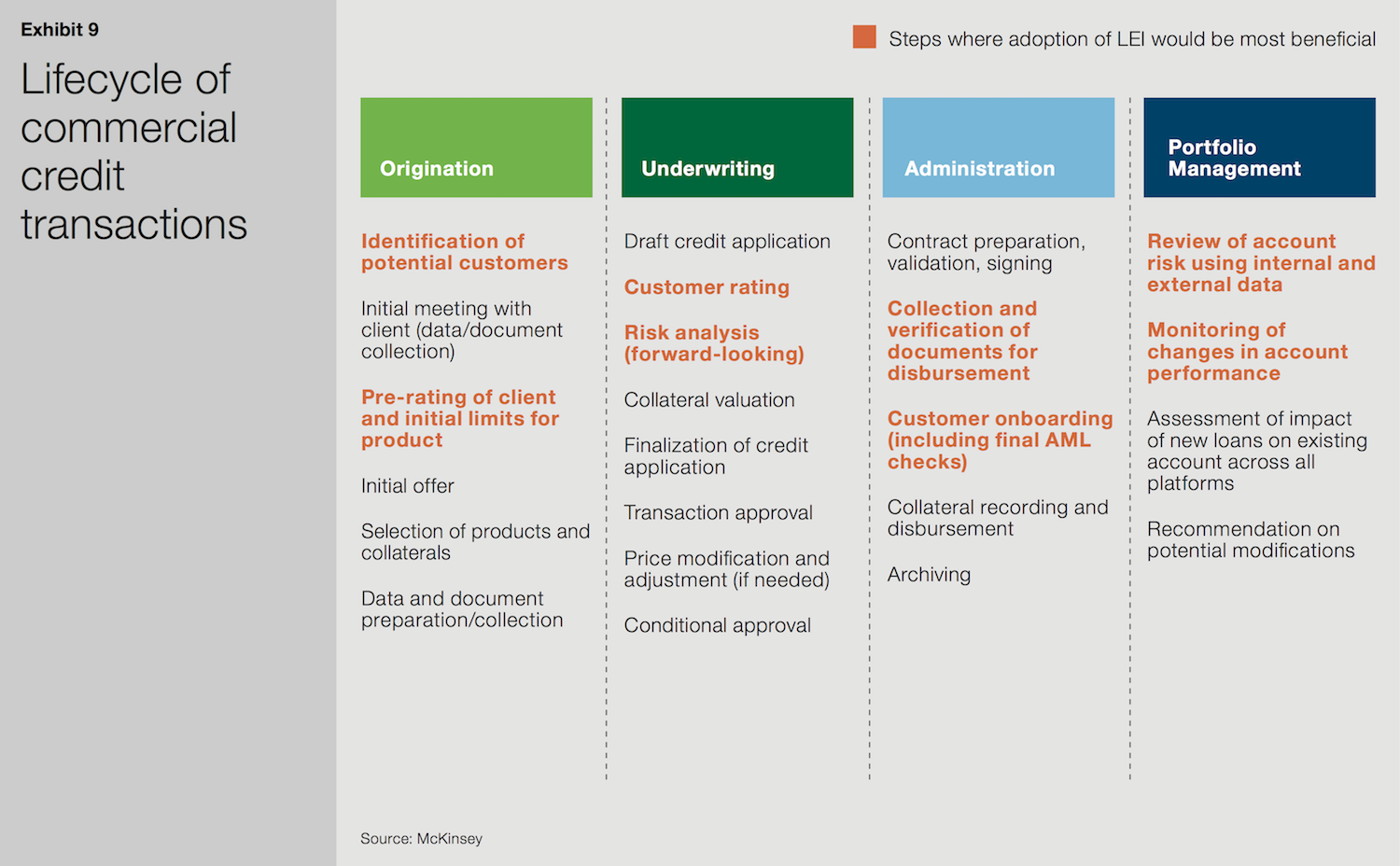

During each of the four key phases of the commercial credit lifecycle (origination, underwriting, administration and portfolio management), various checks are required which are often highly manual and time-consuming. The use of the LEI allows for more robust and efficient know your customer (KYC) on borrowers as well as better traceability of information. All of which will yield considerable financial savings.

Origination

Having correct, verifiable information about the entity’s identity, history with the bank, and external financial/lending history is crucial during the origination phase. Without this information, it is almost impossible to offer appropriate products or assess risk accurately.

Human error is high in application forms with many entities failing to enter their complete name or entering a variation of the entity name previously used. This tendency is especially prevalent among small and medium sized businesses as well as affiliates of larger groups. The use of an LEI would help to standardize this vital information and as such, would significantly reduce the time that banks’ middle-and-back offices spend on manual verification processes.

Underwriting and administration

The ability to easily and accurately trace an entity’s history is even more helpful during the underwriting phase, when final risk analysis and credit approval are undertaken. In addition, during the administration phase, when an entity is being onboarded to the lender’s systems, the use of a single identifier would strengthen and accelerate the required anti money laundering (AML) and compliance checks.

Portfolio management

Finally, after the loan has been issued and the portfolio management phase begins, the lender must use internal and external data to review account risk while also monitoring changes in account performance. This requires a considerable amount of data reconciliation to ensure that the risk profile is up-to-date and accurate. LEIs could expedite data reconciliation and help to confirm its accuracy.

In all four phases of the commercial credit lifecycle, the use of an LEI would facilitate the automation and digitization of processes by providing a new data field that could be standardized across all systems.

To learn more about LEI use cases described with the joint McKinsey and GLEIF white paper, refer to these dedicated GLEIF website pages: ‘LEI in Capital Markets’ and ‘LEI in Trade Finance’.